Understanding and Assessing Impacts

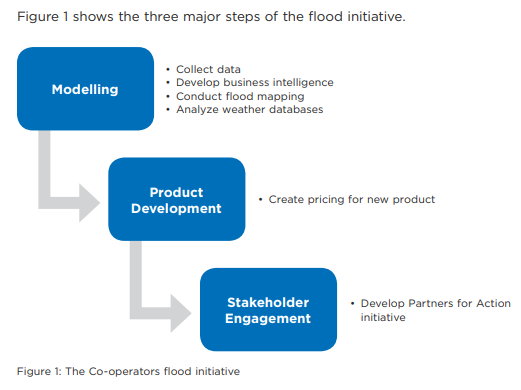

The duration, intensity and frequency of weather events that threaten homes have increased, and floods have become one of highest risks associated with these events. Flooding affects properties and the well-being of residents. Given that Canada (at the time) was the only G7 country without a flood insurance product, a major focus of this study was the flood initiative, which included developing a new insurance product. Another primary focus was undertaking a stakeholder engagement process in order to build community resilience. Although The Co-operators had a flood initiative underway for several years, in 2014 they increased their efforts to complete the initiative after seeing Canadians suffering from the effects of climate change. The key question for The Co-operators senior management was how to provide adequate coverage for their clients at a price point that would be affordable while preserving the organization’s financial strength. A further challenge: although insurers did not provide flood insurance products, almost 70 per cent of Canadian homeowners believed their insurance policy fully covered them for flooding. The major steps in the development of the flood initiative were Modelling; Product Development; and Stakeholder engagement. However, some major challenges associated with developing this new product include developing a product solution that is simple, clear and comprehensive, identifying and quantifying risk, developing an approach to pricing, estimating return on equity (ROE) and return on investment (ROI), creating awareness of the risk exposure related to water, and making the business case for the new product.